2010 Second Quarter

Benefits Explain Why U.S. Employers’ Costs Rise, But Employees Might Feel Worse Off

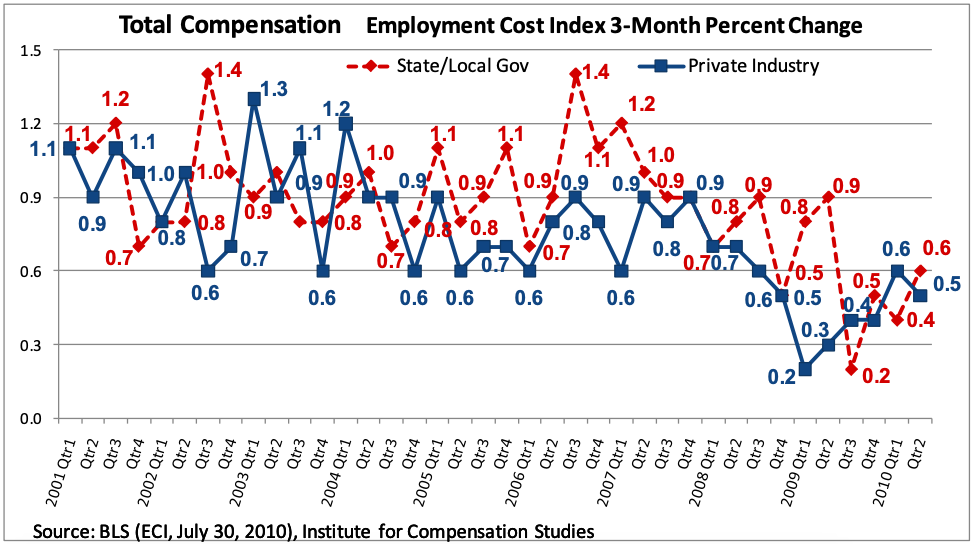

From the first quarter of 2002 through the fourth quarter of 2004, U.S. employees in the private sector and those in state and local government were roughly in balance in terms of the number of quarters that one or the other had the higher three-month percent increase in total compensation. (The three-month percent increase in total compensation for private sector employees exceeded that for local and state government employees in five quarters; the three-month percent increase in total compensation of local and state government employees exceeded that of private sector employees in six quarters; and the increase was identical for the two groups in one quarter.)

However, by 2005, the balance tipped. In every quarter from the fourth quarter of 2004 until the official start of the current recession (Q4 2007), the three-month percent increase in total compensation costs for state and local government employees exceeded that for private sector employees (12 quarters in a row). Since the start of the current recession, only twice in 10 quarters (Q3 2009 and Q1 2010), did the three-month increase in employee total compensation costs for private sector employees exceed those of state and local government employees.

But, has the corner turned for private sector compensation cost increases? An upward trend may be reappearing.

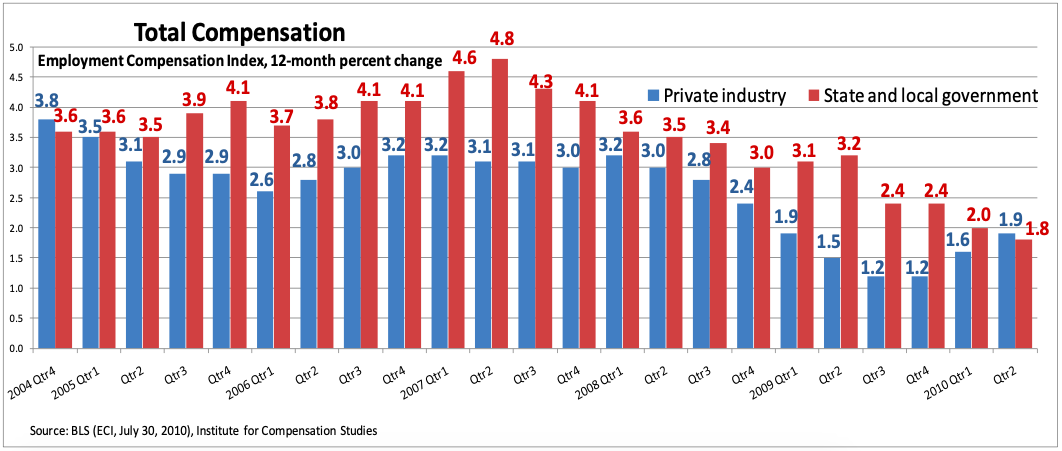

Considering the 12-month percent increase in total compensation, a cleaner cyclical picture appears. Total compensation increases for employees in state and local government continue to decline, but those of private sector employees are on the rise. The second quarter of 2010 was the first in five years that saw a 12-month percent increase in total compensation that was greater for private sector employees than state and local government employees, (1.9 percent to 1.8 percent, respectively).

In all comparisons of private sector and government sector employees, it should be remembered that notable differences exist between the work activities and occupational structures of these two groups. For example, two-thirds of state and local government employees are in professional and administrative support occupations (including teachers), compared to one-half of private sector employees.

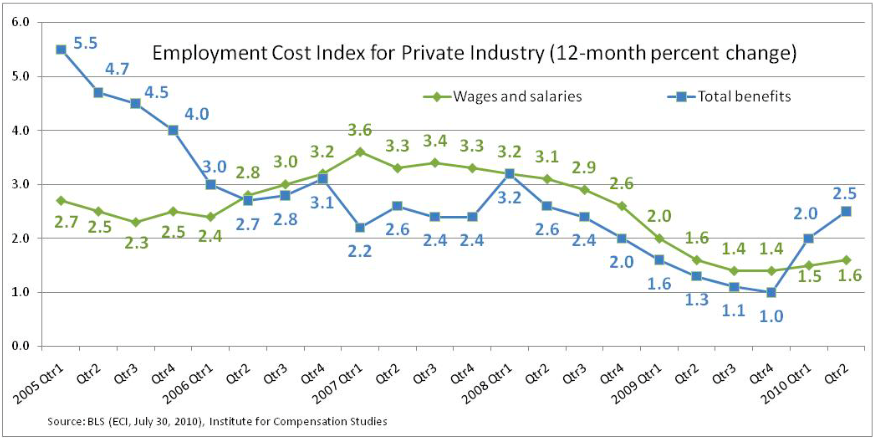

For private sector employees, following seven quarters of shrinking or flat percent increases, this is the second quarter of growth in the 12-month percent increase for both wage and salary costs and benefit costs, with benefits clearly driving more of the overall 1.9 percent growth in 12- month total compensation costs.

The cost of benefits for private sector employees is up 2.5 percent over the past 12 months, while the cost of wages and salaries rose only 1.6 percent since June 2009. Employer costs for health benefits rose more than the rest of the benefits package, up 5.0 percent over the past year. (Nationally, wages and salaries comprise 70 percent of the total cost of employee compensation, with benefits composing the balance.1

See Employer Costs for Employee Compensation, http://www.bls.gov/ncs/ect/home.htm.

)

These data are not necessarily in conflict with widely reported decreases in the June 2010 wage and salary disbursements for the private and government sectors, which were down $5.2 billion and $0.6 billion, respectively. The Bureau of Economic Analysis computations of wage and salary disbursements are reported monthly, but built foremost upon the Bureau of Labor Statistics’ Quarterly Census of Employment and Wages (QCEW) that is the source for the employment cost index series. In fact, the wage and salary disbursements for the second quarter of 2010 reported by the Bureau of Economic Analysis were up over the previous quarter, consistent with the rise in the most recent employment cost index for wages and salaries. To calculate monthly numbers, the Bureau of Economic Analysis includes an estimated component for wages and salaries derived from the monthly Current Employment Statistics survey also produced by the Bureau of Labor Statistics.

The return to rising total compensation cost indexes where the gain is driven strongly by benefits costs (especially health benefits), may do little to satisfy either U.S. employers or employees. Both are looking for signs of better economic times. For private sector employers, labor costs are slowly picking up speed at a time when employers’ appetite for hiring is temperate at best. Many private sector employees, on the other hand, won’t see much in the way of direct cash gains in their wallets with a disproportionate share of rising cost increases driven by benefits -- especially health care -- than by wage and salary increases.