2011 Second Quarter

-

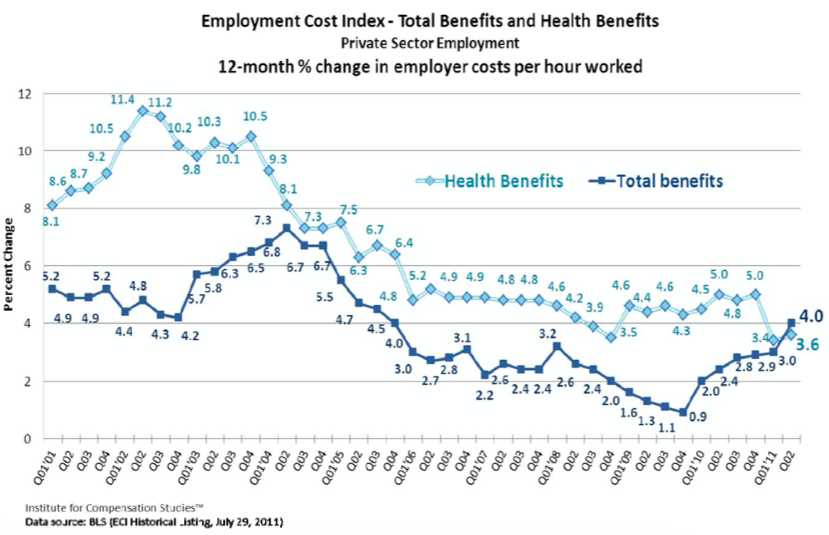

For the first time in over a decade, the cost of private sector employment benefits overall increased faster than those for health care.

-

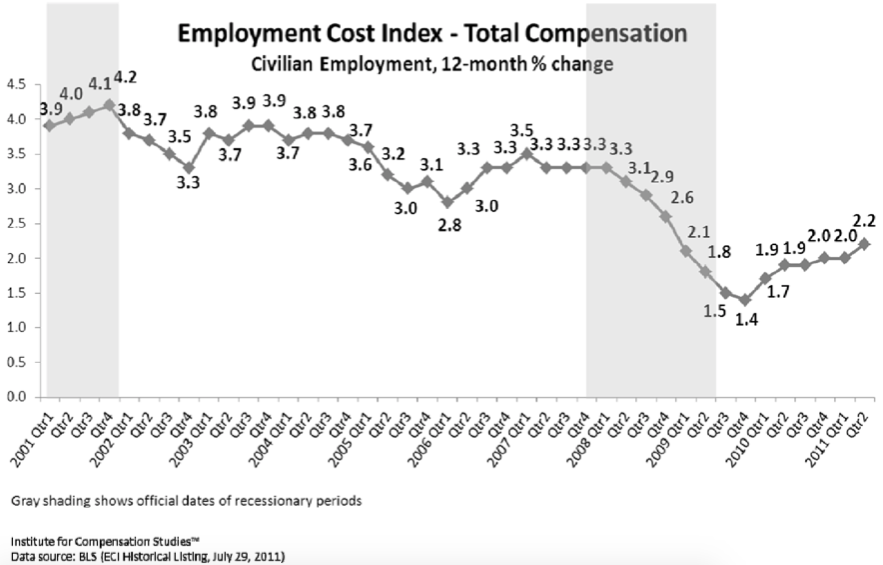

Total U.S. civilian employment costs rose 2.2 percent over the past year – the highest 12-month change since 2008.

ECI continues gentle gains – 12-month percent change highest since 2008

Employer spending on wages, salaries, and benefits across the civilian U.S. labor force for the 12 months ending June 2011 ticked up a bit over 2 percent. According to the Employment Cost Index released Friday July 29, 2011, by the U.S. Bureau of Labor Statistics, compensation costs to civilian employers are 2.2 percent higher than they were a year ago.1

Seasonally adjusted, compensation costs increased 0.7 percent for the 3-month period ending June 2011. This is almost even with the 0.6 percent reported for the previous quarter’s 3-month increase for the period ending March 2011.

This is the highest quarterly report of year-on-year changes since the 12-month ECI reported for the fourth quarter of 2008. It extends the gentle upward trend following the trough of 1.4 percent for the 12 month period ending June 2009.

Annual inflation (CPI-U) currently stands at 3.6 percent.2

During the past 12 months, the Consumer Price Index for All Urban Consumers index increased 3.6 percent before seasonal adjustment. See Consumer Price Index Summary, http://www.bls.gov/news.release/cpi.nr0.htm. For a discussion of trends in food and energy inflation as related to the ECI, see last quarter’s ICS Commentary - U.S. Employment Cost Index, Q1 2011.

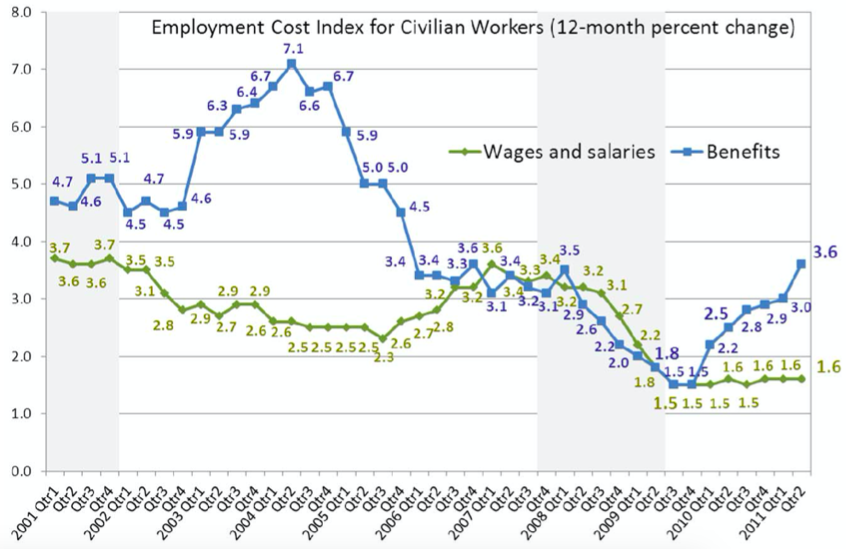

Wage and salary costs vs. benefits

The mild strengthening of U.S. employment cost increases over the past 12 months has been driven by benefits rather than wage and salary costs. The trend in employers’ spending on employee benefits has risen steeply since the trough in the second quarter of 2009. Over the previous 12-month period ending June 2011, benefit costs accelerated to 3.6 percent, up over a year ago when benefit costs rose 2.5 percent and double the 1.8 percent increase over the 12-month period prior to that ending June 2009. Increases in civilian wages and salaries, on the other hand, have been essentially flat since the official end of the recession in June 2009.

Because benefits contribute roughly 30 percent, on average, to the cost that employers pay per employee, the acceleration of benefit costs is material to employers.3

In March 2011, wages and salaries accounted for 69.6 percent of total employee compensation, while benefits accounted for the remaining 30.4 percent. Data for June 2011 is scheduled to be released on Thursday, September 8, 2011, at 10:00 a.m. (EDT). See U.S. Bureau Labor Statistics, News Release, Employer Costs for Employee Compensation news release text, USDL-11-0304, June 8, 2011http://www.bls.gov/news.release/ecec.nr0.htm, downloaded 7/30/11.

Unfortunately, employees “feel” the reward from these benefits less directly than from wages and salaries.4

The exception being supplemental pay such as overtime pay or nonproduction bonus pay which are both included in the BLS definition of benefit costs, rather than salary and wage costs.

This situation may fuel tensions between employees and employers over whether returns from the (soft) business recovery are being fairly shared with employees.

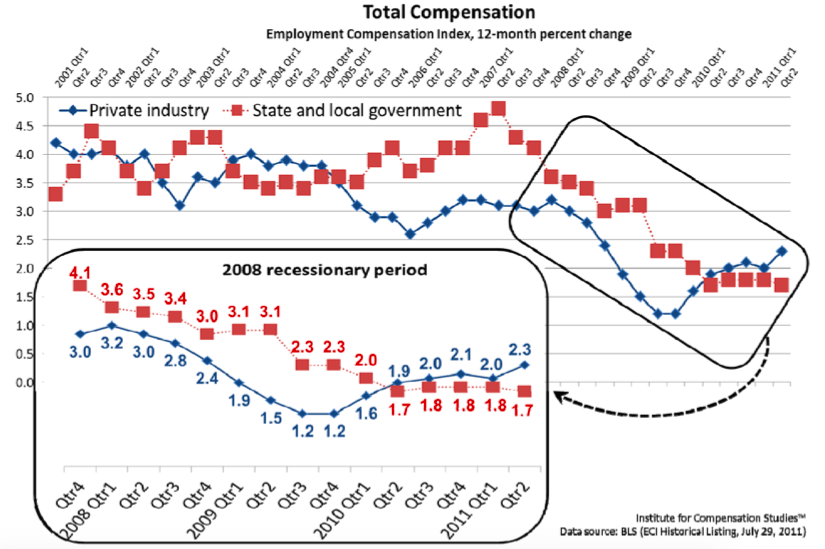

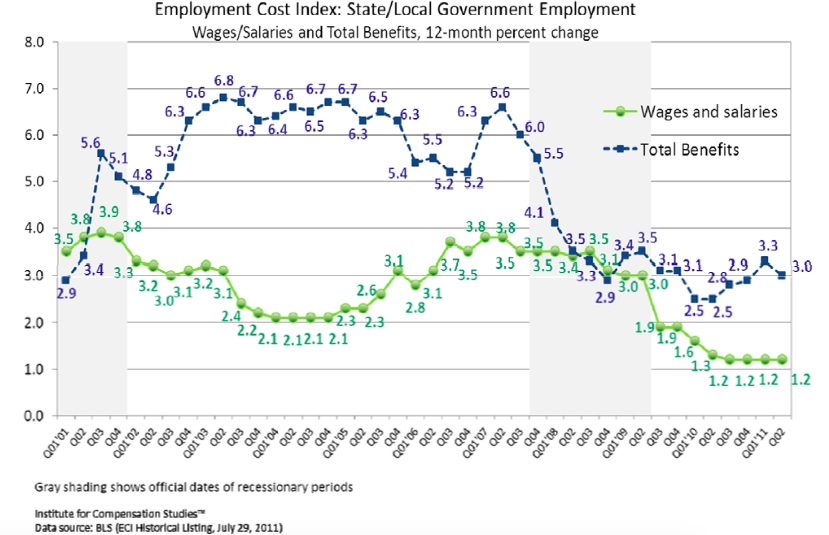

Private sector continues stronger showings than State and Local government

For the five year period Q1 2005 through Q1 2010, the 12-month percent increase in total compensation costs for state and local government employees exceeded that for private sector employees. But for the past five quarters, increases for private sector employees have been higher. Year-on-year total compensation cost increases for state and local employees continue in a recessionary-like trough, while the quarterly 12-month ECI for private sector employees are demonstrating some recovery.5

In all comparisons of private sector and government sector employees, it should be remembered that notable differences exist between the work activities and occupational structures of these two groups. For example, two-thirds of state and local government employees are in professional and administrative support occupations (including teachers), compared to one-half of private sector employees.

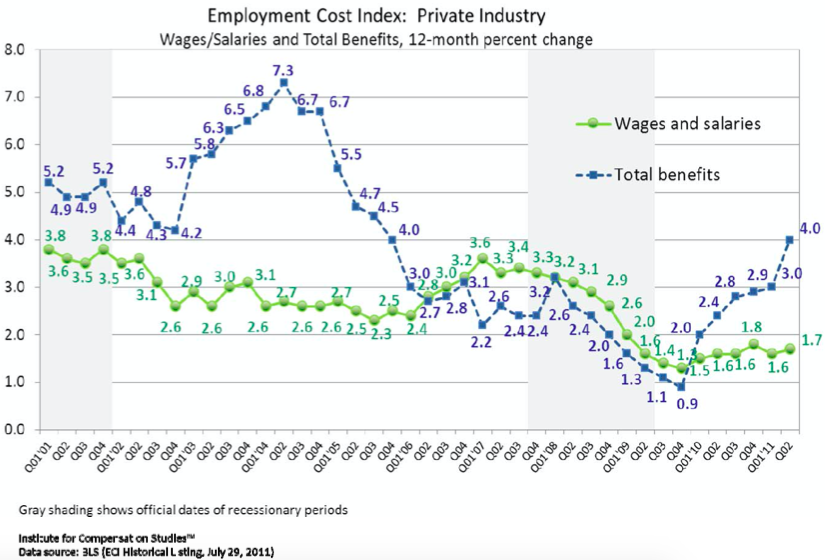

Private sector increases are driven by benefits, but surprisingly not health care

The private sector trend in salary and wage costs suggests that employers are leaning more toward “steady as she goes” than “full steam ahead.” Employer-association surveys are consistent with this very soft upward trend, even as U.S. unemployment rates hover around 9 percent. For example, the most recent surveys by WorldatWork and IOMA/BNA show slight increases in 2011 “actual salary budgets” and 2012 forecasts of executive merit pay, respectively.6

WorldatWork 2011-2012 Salary Budget Survey: Top-Level Data, July 05, 2011, accessed on 7/30/11 http://www.worldatwork.org/waw/adimLink?id=53234; IOMA/BNA, Report on Salary Surveys, “Executive Merit Pay at 3.1Percent for 2012, Survey Finds” August 1, 2011, Number 8.

The recent acceleration in private sector employers’ costs is mostly a story about benefits. This quarter’s acceleration in the 12-month percent change in benefit costs is steep, increasing to 4.0 percent from 3.0 percent for the 12-month period ending March 2011. Not since the end of 2005 has a 12-month increase in private sector benefit costs been this large.

But, surprisingly, private sector employers appear to still be holding firm on increases in health care benefit costs. Increases for private sector employer costs for health benefits accelerated somewhat to 3.6 percent for the 12-month period ending June 2011. While this is an increase from last quarter’s 12-month index for the period ending March 2011 (3.4%), it is still among the lowest of the past decade.7

U.S. Bureau of Labor Statistics, National Compensation Survey, Employment Cost Index—Supplemental Data, July 29, 2011, http://www.bls.gov/ect/sp/echealth.pdf, accessed 7-30-11. The Bureau of Labor Statistics’ Employment Cost Index includes measures of change in the cost of employee benefits. Data are collected for individual benefits within several benefit categories: paid leave, supplemental pay, insurance benefits, retirement and savings, legally required benefits, and other benefits. The measure of change in the cost of health insurance presented in this Supplemental Data document is the only benefit for which BLS makes separate data available.

And, private sector healthcare benefit costs actually rose more slowly over the past year than benefit costs overall. This has not happened since the late 1990s.

Other than Health Insurance, costs for Total Benefits as defined by the US. Bureau of Labor Statistics include: other Insurance (Life, Short-term disability, Long-term disability), as well as Paid Leave (Vacation,Holiday,Sick,Personal),SupplementalPay(Overtime and premium, 8 Shift differentials, Non production bonuses), Retirement and Savings (Defined benefit, Defined contribution), and Legally Required Benefits (Social Security and Medicare, Social Security, Medicare, Federal unemployment insurance, State unemployment insurance, Workers’ compensation).

The relatively higher growth of non-health benefit costs may in part be explained (1) by average weekly overtime hours, which have been rising since their low in the first half of 2009; and (2) reinstatement of benefits that were cut during the worst of the recession such as contributions to defined contribution plans and paid leave, for which there is some anecdotal evidence. These actions are consistent with economic recovery.

Public sector cost increases continue holding pattern

Public sector salary and wage costs increased 1.2 percent over the 12-month period ending June 2011. This is the fourth quarter that state and local government employers reported an increase of just 1.2 percent. With 12-month inflation at 3.6 percent, salary and wage costs for state and local

governments are shrinking in real terms. Increases in benefit costs are higher. Year-on-year increases in benefit costs appear to be hovering around 3 percent, but with no signal of recovery (acceleration) like observed in the private sector.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8Includes premium pay for work in addition to the regular work schedule (such as overtime, weekends, and holidays). See U.S. Bureau of Labor Statistics, Employer Costs for Employee Compensation, March 2011, http://www.bls.gov/news.release/pdf/ecec.pdf, released Wednesday, June 8, 2011, accessed 7/31/11.