2021 Third Quarter

2021 Third Quarter: Annual compensation growth accelerates but falls far short of inflation; largest increases were in wages and salaries for private-sector workers and those in service occupations

Civilian workers’ compensation costs 12-month growth rate of 3.7 percent growth is the highest in 17 years

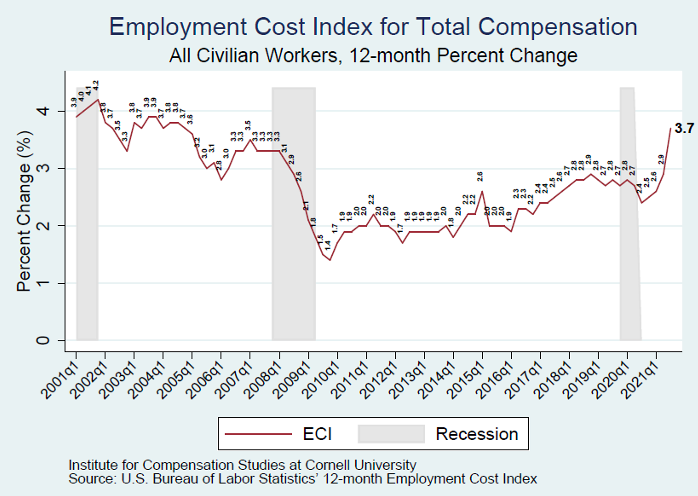

Released October 29, 2021, the U.S. Bureau of Labor Statistics’ 12-month Employment Cost Index (ECI) in the third quarter of 2021 rose strongly to 3.7 percent (Chart 1), the highest growth rate since Q3 2004, although it still lagged inflation. Behind this high average trend lies an unusually high degree of variation among occupational groups.

Chart 1

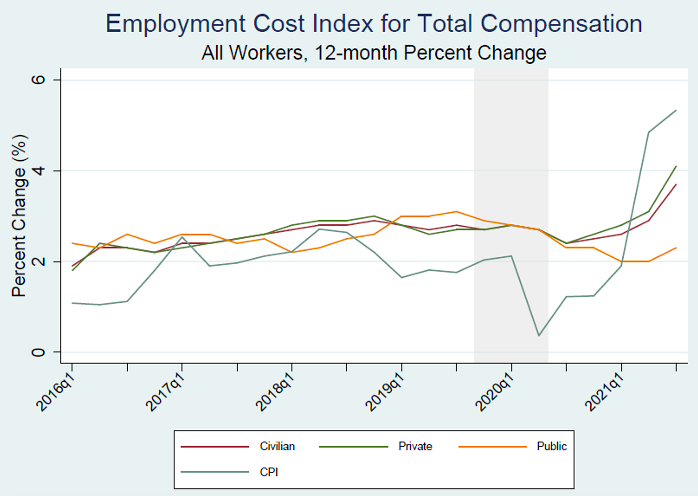

2021 Q3 12-month ECI growth less than recent inflation and concentrated in the private sector

Yet, recent compensation cost increases lag behind inflation. The recent acceleration in compensation increases have been concentrated in the private sector. Government compensation cost growth has been subdued. At the same time, price inflation has been rising. As of Q3 2021, the 12-months rise in consumer prices (5.3 percent) was much higher than compensation costs increases (3.7 percent), especially for government workers (2.3 percent). Thus, workers’ real earnings lost ground, particularly in the public sector.

Chart 2

Data sources: U.S. Bureau of Labor Statistics, Employment Cost Index and Consumer Price Index.

Private sector compensation accelerates, while public sector compensation growth rises modestly

Breaking total compensation into its key components of earnings (wages and salaries) and benefits, total benefits typically account for about 30 percent of employer costs for employee total compensation. Table 1 reports the ECI trends for each of these categories by public and private sector. The recent high growth in compensation is primarily due to high wage and salary growth in the private sector.

The table also shows that public and private sector compensation components moved quite differently over the year. Public sector compensation costs slowed more during the pandemic than private sector compensation and have only now returned to prior growth rates.

In the private sector, comparing the 12 months ending in September 2020 with the 12 months ending in September 2021, we see a notable pick-up in wage and salary growth (from 2.7 percent to 4.6 percent—the highest growth rate since the series began in Q1 2001), while benefits costs growth rose at a more typical rate of 2.6 percent.

By contrast, the two components of public sector compensation grew much more slowly. Recent changes also offset each other. Comparing the 12 months ending in September for 2020 and 2021, wage and salary growth rose from 1.8 percent to 2.4 percent while benefits cost growth slowed from 3.2 percent to 2.1 percent.

Table 1

|

Major series of the Employment Cost Index [Percent change] |

|

|||||

|

Category |

12-month, not seasonally adjusted |

|||||

|

Sep. |

Dec. |

Mar. |

Jun. |

Sep. |

||

|

Civilian workers (1) |

||||||

|

Compensation (2) |

2.4 |

2.5 |

2.6 |

2.9 |

3.7 |

|

|

Wages and salaries |

2.5 |

2.6 |

2.7 |

3.2 |

4.2 |

|

|

Benefits |

2.3 |

2.1 |

2.5 |

2.2 |

2.5 |

|

|

Private industry |

||||||

|

Compensation (2) |

2.4 |

2.6 |

2.8 |

3.1 |

4.1 |

|

|

Wages and salaries |

2.7 |

2.8 |

3.0 |

3.5 |

4.6 |

|

|

Benefits |

2.0 |

2.1 |

2.5 |

2.0 |

2.6 |

|

|

State and local government |

||||||

|

Compensation (2) |

2.3 |

2.3 |

2.0 |

2.0 |

2.3 |

|

|

Wages and salaries |

1.8 |

1.8 |

1.6 |

1.5 |

2.4 |

|

|

Benefits |

3.2 |

3.1 |

2.6 |

2.6 |

2.1 |

|

Footnotes

(1) Includes private industry and state and local government.

(2) Includes wages and salaries and benefits.

Prepared by Cornell Institute for Compensation StudiesTM

Data Source: BLS (ECI Historical Listing, October 29, 2021)

Private sector 12-month compensation growth varies widely by occupation

Private sector compensation growth accelerated for all occupational groups (see Chart 3). In addition, growth rates diverged strongly, likely reflecting a high degree of pandemic-related flux in labor supply and demand conditions. Indeed, the standard deviation of growth rates by major occupational group is the highest since this series began in 2001. Over the last 12 months, earnings grew slowest (3.5 percent) for professional and managerial occupations and twice as fast for service occupations (6.8 percent).

Chart 3

Prepared by Cornell Institute for Compensation StudiesTM

Data Source: US Bureau of Labor Statistics Employment Cost Index

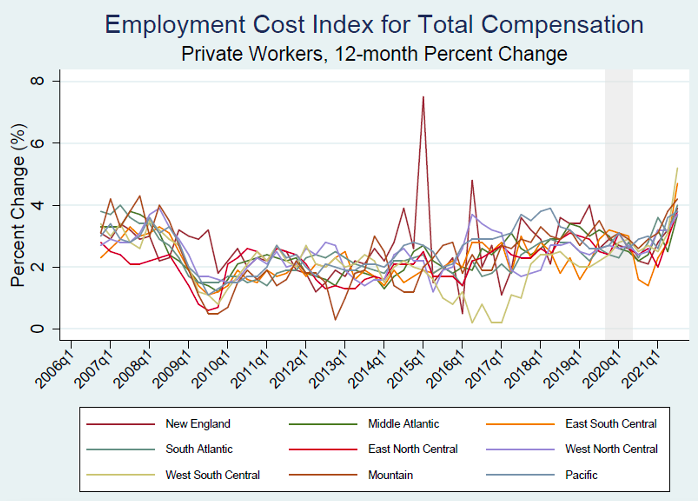

Compensation growth increases across all regions

All regions of the country saw rises in 12-month compensation growth (see Chart 4). At 5.2 percent, growth was strongest in West South Central states (Arkansas, Louisiana, Oklahoma, and Texas). Mid-Atlantic states (New Jersey, New York, and Pennsylvania) and West North Central states (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, and South Dakota) were tied for lowest growth rates at 3.7 percent.

Chart 4

The Census divisions are defined as follows: New England: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont; Middle Atlantic: New Jersey, New York, and Pennsylvania; South Atlantic: Delaware, District of Columbia, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, and West Virginia; East South Central: Alabama, Kentucky, Mississippi, and Tennessee; West South Central: Arkansas, Louisiana, Oklahoma, and Texas; East North Central: Illinois, Indiana, Michigan, Ohio, and Wisconsin; West North Central: Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, and South Dakota; Mountain: Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, and Wyoming; and Pacific: Alaska, California, Hawaii, Oregon, and Washington.

Prepared by Cornell Institute for Compensation StudiesTM

Data Source: US Bureau of Labor Statistics Employment Cost Index

The Employment Cost Index (ECI) released October 29, 2021 by the U.S. Bureau of Labor Statistics reflects trends in the costs to employers for the total compensation, wages, and benefits they provide to their workers, controlling for composition of the workforce. The ECI is one of the labor market indicators used by the Federal Reserve Board to monitor the effects of fiscal and monetary policies and is released quarterly. The BLS summary can be found at https://www.bls.gov/news.release/eci.nr0.htm.