U.S. Employment Cost Index, Q2 2024 Commentary

2024 Second Quarter Summary – Compensation costs continue to rise faster than inflation: good news for workers, especially union workers

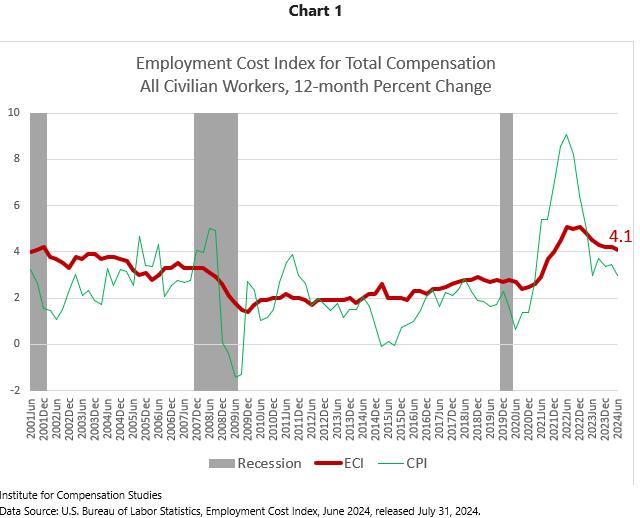

The 12-month growth rate of compensation costs, released on July 31, 2024 by the U.S. Bureau of Labor Statistics, again exceeded consumer inflation, while both continue softening. Slowing to 4.1 percent in Q2 (June) 2024, the growth rate of employer cost for employee compensation (controlling for occupational composition) remained higher than the general price inflation for U.S. households (CPI) for a fifth quarter running.

Table 1

|

Employment Cost Index 12-month % change, not seasonally adjusted All Civilian Workers |

|||

|

Total Compensation |

Wages and Salaries |

Total Benefits |

|

|

2020 Q1 |

2.8 |

3.1 |

2.1 |

|

Q2 |

2.7 |

2.9 |

2.2 |

|

Q3 |

2.4 |

2.5 |

2.3 |

|

Q4 |

2.5 |

2.6 |

2.3 |

|

2021 Q1 |

2.6 |

2.7 |

2.5 |

|

Q2 |

2.9 |

3.2 |

2.2 |

|

Q3 |

3.7 |

4.2 |

2.5 |

|

Q4 |

4.0 |

4.5 |

2.8 |

|

2022 Q1 |

4.5 |

4.7 |

4.1 |

|

Q2 |

5.1 |

5.3 |

4.8 |

|

Q3 |

5.0 |

5.1 |

4.9 |

|

Q4 |

5.1 |

5.1 |

4.9 |

|

2023 Q1 |

4.8 |

5.0 |

4.5 |

|

Q2 |

4.5 |

4.6 |

4.2 |

|

Q3 |

4.3 |

4.6 |

4.1 |

|

Q4 |

4.2 |

4.3 |

3.8 |

|

2024 Q1 |

4.2 |

4.4 |

3.7 |

|

Q2 |

4.1 |

4.2 |

3.8 |

Institute for Compensation Studies

Data Source: U.S. Bureau of Labor Statistics, Employment Cost Index, June 2024, released July 31, 2024.

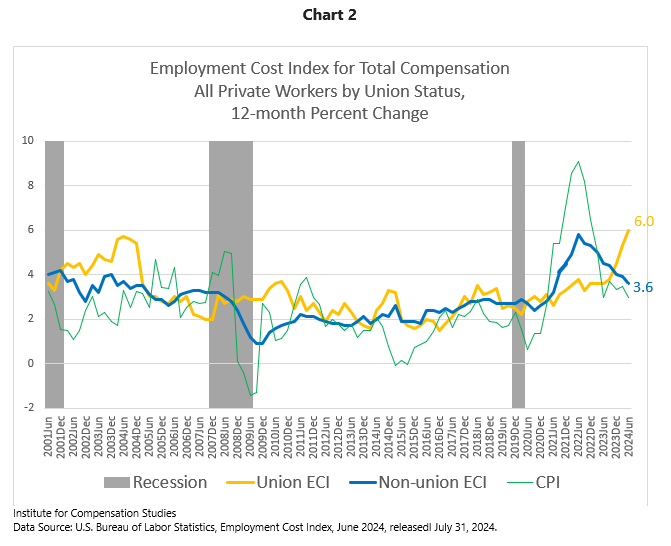

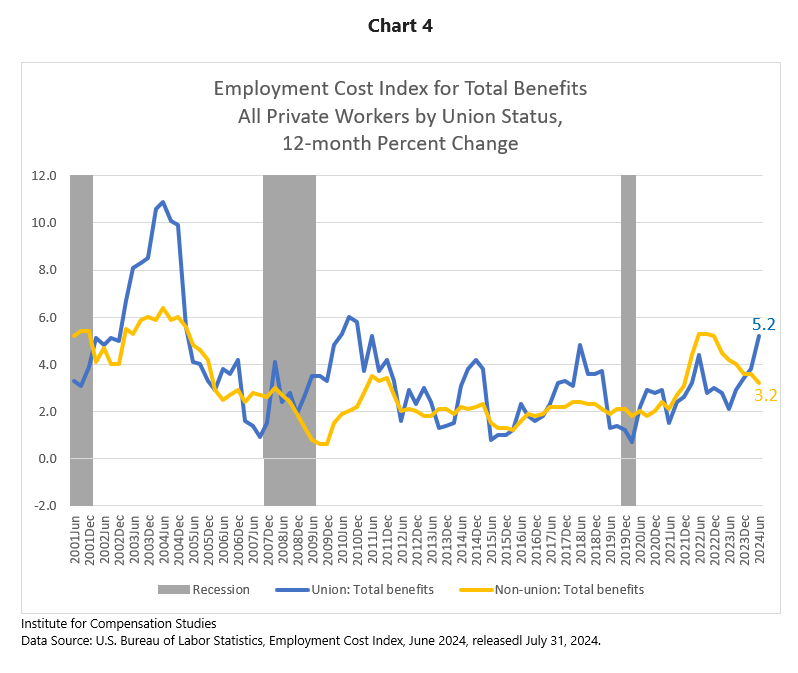

Strong counter trends continue for compensation growth rate of union versus non-union workers

The softening of compensation cost increases for the economy overall masks the dramatic divergence in compensation growth between of union and non-union workforces. Since its peak in Q2 (June) 2022, the non-union 12-month ECI for total compensation has exhibited a strong downward trend while that for union workers has risen steadily. This quarter, the annual growth rate of compensation costs for non-union employees dipped further to 3.6 percent, while that for union workers reached 6.0 percent, exceeding the rebound peaks following both the 2001 and 2008 recessions.

Without cost-of-living adjustments, multi-year union contracts can slow increases in the employer cost of employee compensation during times of rapid inflation, only to rapidly reverse course as new contract terms are negotiated. Following four quarters of increases in non-union worker compensation that outstripped those their unionized counterparts (June 2021 through June 2022), employer costs for non-union employee compensation, now continues to rise more slowly than that for union workers, though still above consumer price inflation.

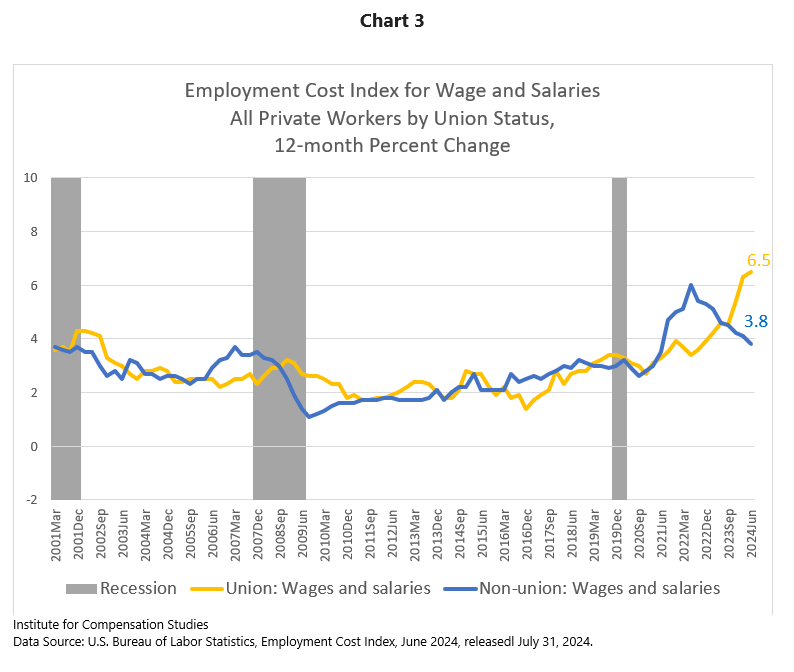

The countertrends of the 12-month ECI for union versus non-union workers remain when considering wages and salaries separately from benefits. Wages and salaries of union workers increased 6.5 percent over the past 12 months, compared to 3.8 percent for non-union workers.

Similarly, the employer cost of employee benefits for union workers increased 5.8 percent over the past 12 months, compared to 3.2 percent for non-union workers.

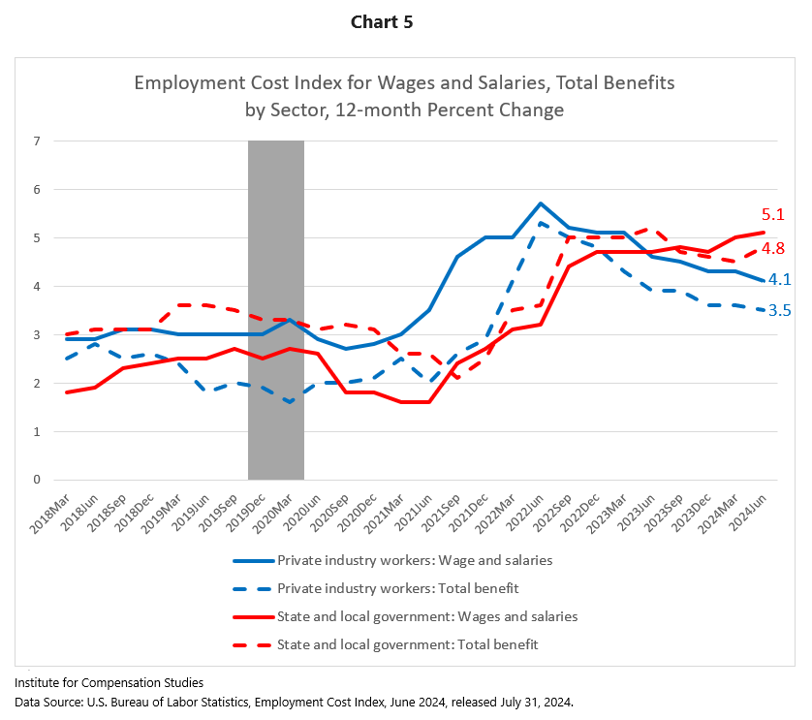

Growth holding firm in government sector wages and salaries

Softer overall ECI growth is also more apparent in the private sector than the government sector. The 12-month growth rates of wages and salaries and of benefits for government sector workers have exceeded those for their private sector counterparts for four quarters and six quarters, respectively (Chart 5). While the ECI for government sector wages and salaries increased modestly to 5.1 percent in Q2, that for private sector employees declined to 4.1 percent. This slowing growth rate of private sector compensation continues a two-year softening trend. Government sector compensation responds more slowly to economic changes than does private sector compensation. These lags suggest that government compensation growth may be at or near its post-pandemic peak.

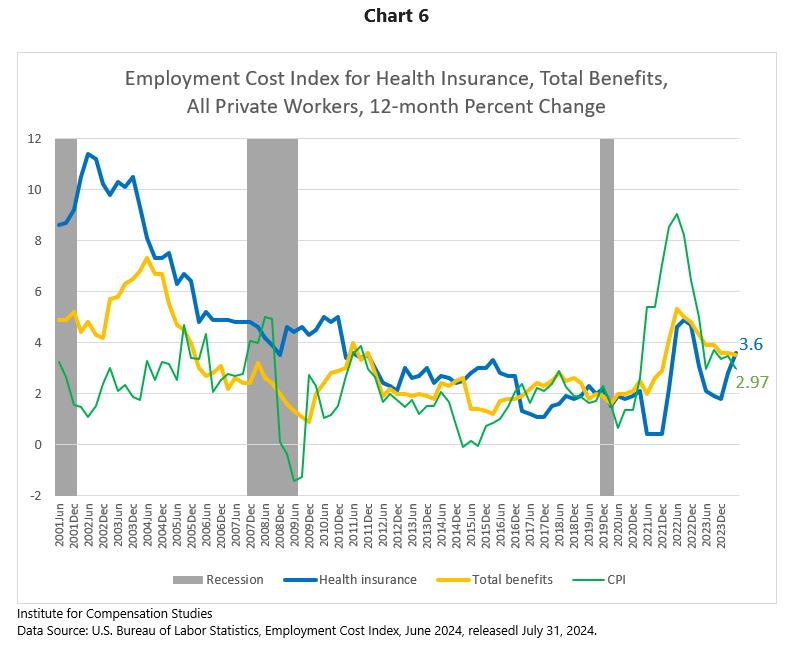

Health insurance benefit costs rise faster than CPI for the first time in three years

While fluctuating notably since June 2021, the growth rate of employer costs for employee health insurance benefits may be demonstrating a post-Covid structural break. After falling dramatically over the past two decades, the trend in the growth rate of private sector health insurance benefit costs appears to have reversed course since bottoming out in the second half of 2021. The ECI for health insurance is rising, albeit erratically, and for the first time since early 2021, registered above the CPI.

The Employment Cost Index (ECI) is produced by the U.S. Bureau of Labor Statistics to measure trends in the costs of compensation paid by employers to their employees, controlling for composition of the workforce. The ECI is one of the labor market indicators used by the Federal Reserve Board to monitor the effects of fiscal and monetary policies and is released quarterly with a one-month lag.

Data for the Q2 2024 reference period were collected from a probability sample of approximately 23,600 occupational observations selected from a sample of about 5,600 private industry establishments and approximately 7,500 occupational observations selected from a sample of about 1,400 state and local government establishments that provided data at the initial interview.

Link to most recent ECI release: https://www.bls.gov/news.release/eci.toc.htm.

The Institute for Compensation Studies (ICS) at Cornell University’s ILR School is an interdisciplinary center that researches, teaches and communicates about monetary and non-monetary rewards from work, and how these rewards influence outcomes for individuals, companies, industries, and economies. At thecrossroads between scholarship and practice, ICS is an exchange dedicated to helping new knowledge hit its mark in the world of work.

Contact:

Erica Groshen

Senior Economics Advisor

Institute for Compensation Studies

Authors:

Seung-Hun Chung

Erica Groshen

Linda Barrington

The Institute for Compensation Studies